AUD/NZD Downtrend Analysis: Can Bulls Overcome Bearish Pressure?

The Australian dollar, also known as the Aussie, has been given a much-needed boost thanks to China's recent PMI data exceeding expectations. This news has been particularly exciting for Australia as China is their largest trading partner. A strong Chinese economy can result in increased demand for Australian markets, leading to a potentially more robust currency market for AUD.

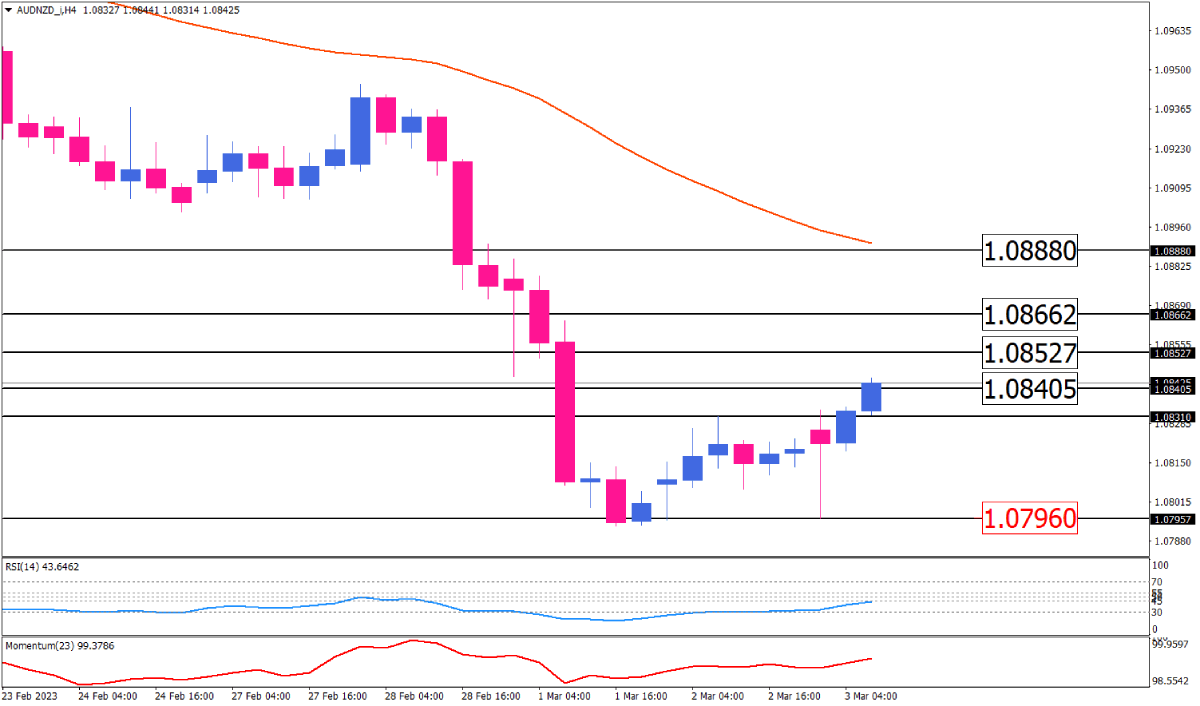

Taking a look at the AUD/NZD four-hour chart, we can see that the currency pair is currently experiencing a downtrend. Despite some attempts by bullish investors to bounce off the 1.07960 bottom during the recent week, the bearish trend is still very much intact. However, things may start looking up for buyers if they manage to overcome the 1.08405 hurdle, with the 1.08527 and 1.08662 levels being the next targets in their sights. A rise above these levels could also put the 1.08880 area in focus, which is in line with the 50 EMA. But wait, don't get too excited just yet, as the falling trendline may still pose a challenge to any further rises in the meantime.

On the other hand, if sellers manage to regain control, the price may return to the 1.07960 barrier. Should the support fail to hold, the downtrend may resume. It's worth noting that short-term momentum oscillators indicate a retreat of sellers, with the RSI turning upward after previously sinking into oversold territory. Momentum is also showing some signs of recovery but is still in the selling area.

Overall, it's important to keep an eye on the current market trends and developments, particularly with regard to Australia and China's economic relationship, as these factors can greatly impact the AUD/NZD currency pair.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.