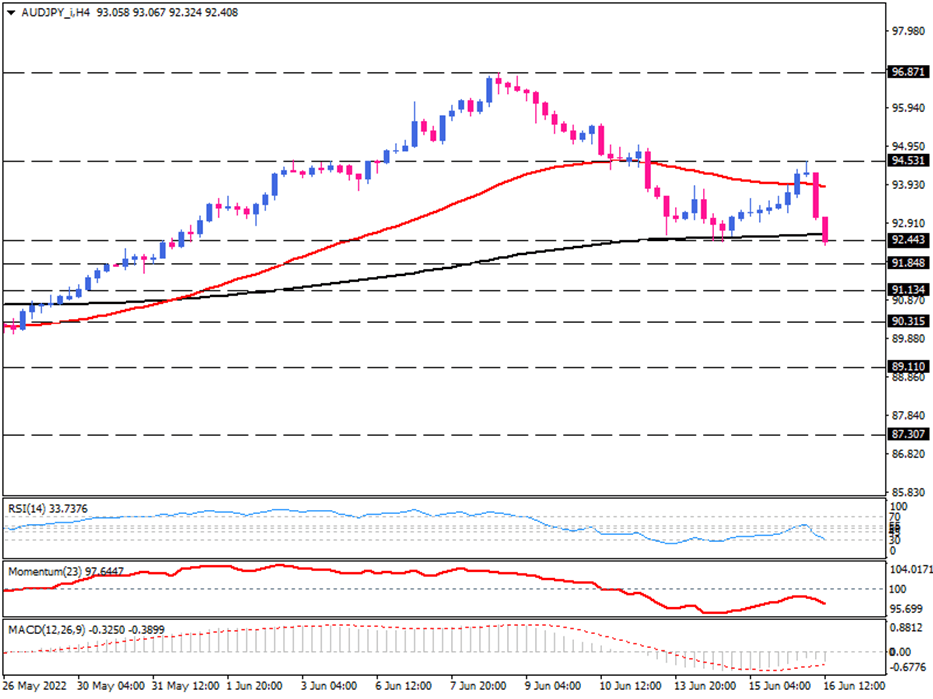

AUD/JPY sellers attempt to break the range

On the four-hour chart, after peaking at 96.871, making a lower high at 94.531 proved AUD/JPY buyers feel exhausted, which is an encouraging sign for sellers to retake control in the absence of efficient bullish momentum. AUD/JPY has stuck in a range between 94.531 and 92.443. however, the mid-day trading session witnessed sellers attempting to break below the 92.443 hurdle, which had held support for some time. A sustained move below this level can make the outlook bearish and bring the immediate target of 91.848 into the spotlight. If sellers manage to keep the pair below the 200-EMA, they may find enough momentum to pass this barrier and reach the 91.134 barricade. By breaking through this level, the 90.315 can prove to be the next support, as the price has tested it several times on May 19 and 20.

Alternatively, suppose buyers defend the 92.443 crucial level, lining with the 200-EMA. In that case, they may erase some losses by retesting the previous top at 94.531. further traction will invalidate the bearish scenario and put the Aussie buyers on track for claiming seven-year highs at around 96.871.

Momentum oscillators support strengthening bearish momentum. RSI is falling sharply in the selling region and may reach the 30-level soon. Momentum is also trending down below the 100-threshold. Likewise, MACD bars tend to cross the signal line in the negative territory if bearish momentum persists.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.