EUR/USD consolidation awaits US inflation figures

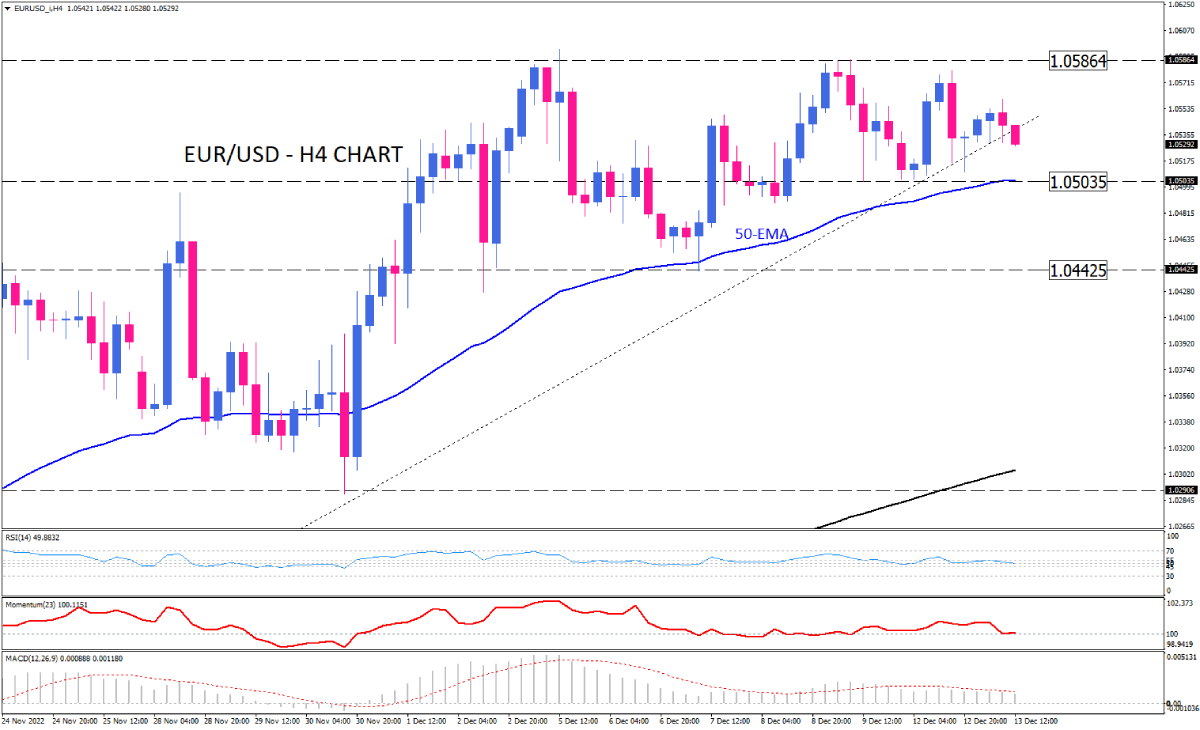

EUR/USD continues to consolidate below the key level of 1.05864 along with its uptrend line on the four-hour chart as market participants are waiting for the latest US inflation data due later in the session.

A 0.3% increase in Core CPI in November would likely trigger another leg of the US Dollar selloff based on the 'Fed pivot' narrative. If that’s the case, euro buyers will attack the 1.05864 hurdle. Meanwhile, a print above 0.5% could cause markets to position themselves for a hawkish Fed message on Wednesday, boosting the US Dollar and pushing down EUR/USD towards the 50-EMA, which is in line with 1.05035. further decline below this barrier will put 1.04425 into the spotlight.

Although a soft inflation report may pressure the US Dollar, we should carefully note that market participants might resist betting on a sustained EUR/USD rally. This is because the ECB is also expected to announce its policy decisions on Thursday, and there is a possibility that the ECB may adopt a more gradual approach towards enforcing its policies in the near future.

Short-term momentum oscillators reflect the market consolidation. RSI is moving within the neutral zone. Momentum is crawling attached to its 100-threshold without any directional indication. At the same time, MACD bars are flattening near zero.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.