EUR/CAD buyers approach the seven-week top

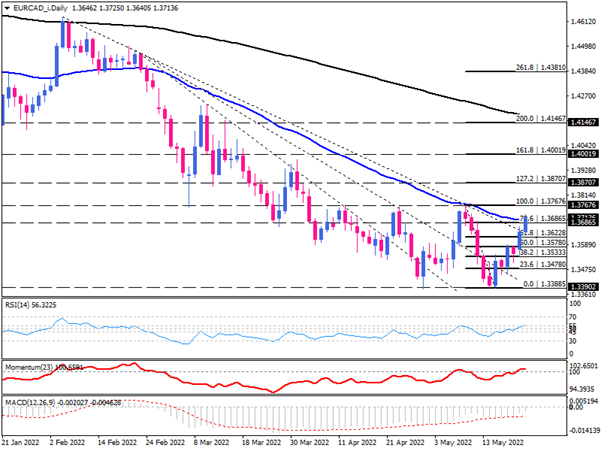

Since early February, EUR/CAD has been trading in a downtrend below the 50-day and 200-day exponential moving averages. Euro buyers are about to erase all the losses from the previous downswing from May 10 to May 17, as rising momentum has allowed them to penetrate the falling trendline and attack the 50-day EMA after hitting a seven-year low of 1.33885 for the second time.

Once they regain the May peak at 1.376676, the double bottom pattern will be complete. Even if prices consolidate at this level for a short time, as long as bulls stay above the 50-day EMA, they will remain hopeful of a bullish reversal.

A decisive penetration above the 1.37676 can pave the way toward the next resistance level, estimated at 127.2% Fibonacci level around the 1.38707 mark. Persisting positive momentum can be mirrored in overcoming this barrier which may send the price towards the 1.400 psychological level aligning with the 161.8% extension of the previous down-swing.

Alternatively, should the 50-EMA halt the rally, sellers find the chance to drag the price down to the broken trendline around 1.36228. a sustained move below this hurdle can put the seven-year lows around 1.33885 in the spotlight. A clear break below this crucial support triggers a bearish signal to resume the prior downtrend.

Momentum oscillators suggest negative bias is waning. The RSI has climbed from the oversold area to the border of buying region. Momentum is also trending up above the 100-threshold. Likewise, negative MACD bars are shrinking above the signal line and may soon reach the zero level. These three oscillators have also shown a clear divergence from the price.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.