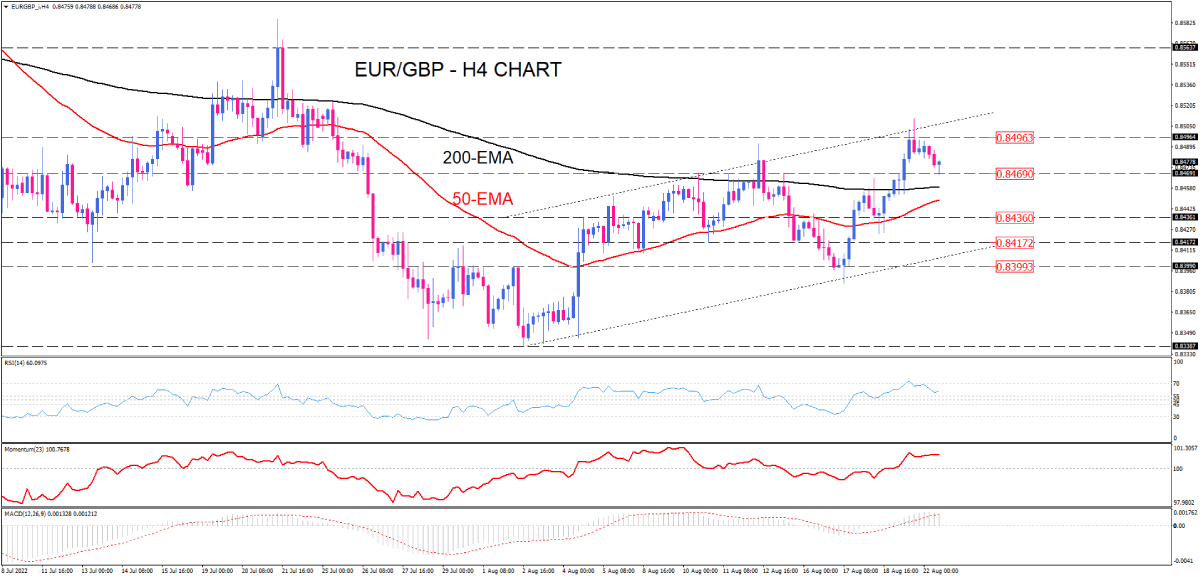

EUR/GBP retreating from channel’s resistance

Since early August, EUR/GBP has been trading in a mild rising channel on the four-hour chart. After a week, the price returns to the channel’s resistance again, coinciding with the 0.84964 mark. Retreating from the peak has dragged the pair down to test the 0.84690 previous level of interest. Should the bearish momentum accelerate, this level may be broken, sending the price toward its 200-period exponential moving average. As the EMAs narrow, they form a confluence of support below the price, which may delay the fall for a while. Otherwise, a sustained move below this hurdle can intensify bearish sentiment, with sellers aiming for 0.84360. The further decline will turn the sellers’ attention to the channel’s support at around 0.84172.

Alternatively, if 0.84690 is held as support, then fresh buying pressure will push the EURGBP to capture 0.84963.

Short-term momentum oscillators point to a probable reversal in the price. RSI is falling back from the overbought area toward the 50-level. Momentum had paused its upward movement, flattening above the 100-threshold. Positive MACD bars are shrinking toward zero, crossing below the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.