EUR/JPY bulls take a breather at a solid resistance

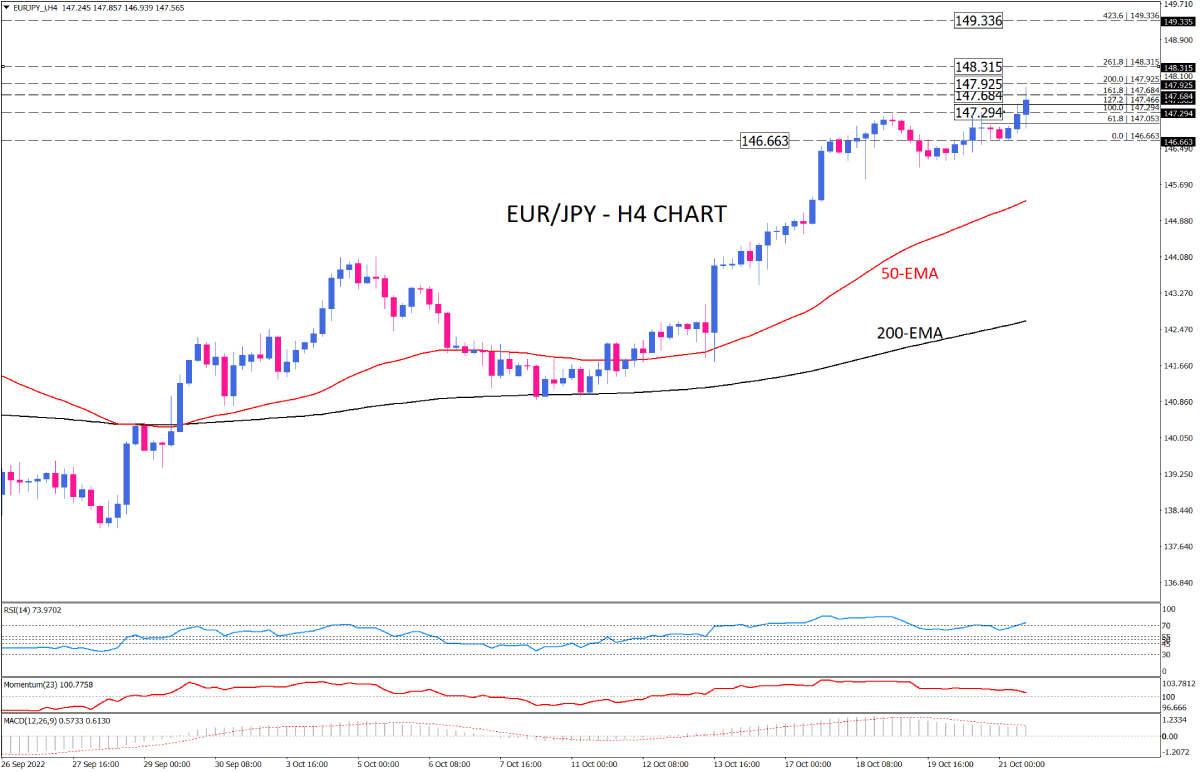

EUR/JPY bulls gain more hope after breaking the 147.294 market top on Friday, which led to a breakout of the recent consolidation as well. The pair seems to remain on the front foot as the Japanese yen continues to weaken against major rivals.

The broad picture is bullish as the 50-EMA is rising in distance above the 200-EMA and the price has been forming higher tops and higher bottoms. However, it should be noted that short-term momentum oscillators imply fading bullish bias, which means that overcoming 147.684 can be challenging in the short run. RSI is hovering above the 70-level in the overbought region, suggesting that buyers are getting exhausted and may retreat soon. Momentum stands above the 100-threshold. Yet, the oscillator diverges from the price. Likewise, MACD bars are flattening in the positive region below the signal line. Given that, buyers need more strength to keep the rally.

Currently, the EUR/JPY rally is struggling at 147.684. In the event that bulls overcome this hurdle, further optimism can push the price higher towards the 147.925 mark. Should buying pressure last longer, the next resistance can confront the rally around the 148.315 hurdle. A sustained breach of this roadblock will put the 149.336 hurdle in the buyers’ sight.

Otherwise, should sellers take advantage of the overbought condition, they may retake control, pushing the pair lower to test the last bottom around 146.663. further selling pressure can result in a clear break of this barrier, extending the decline towards the 50-EMA.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.