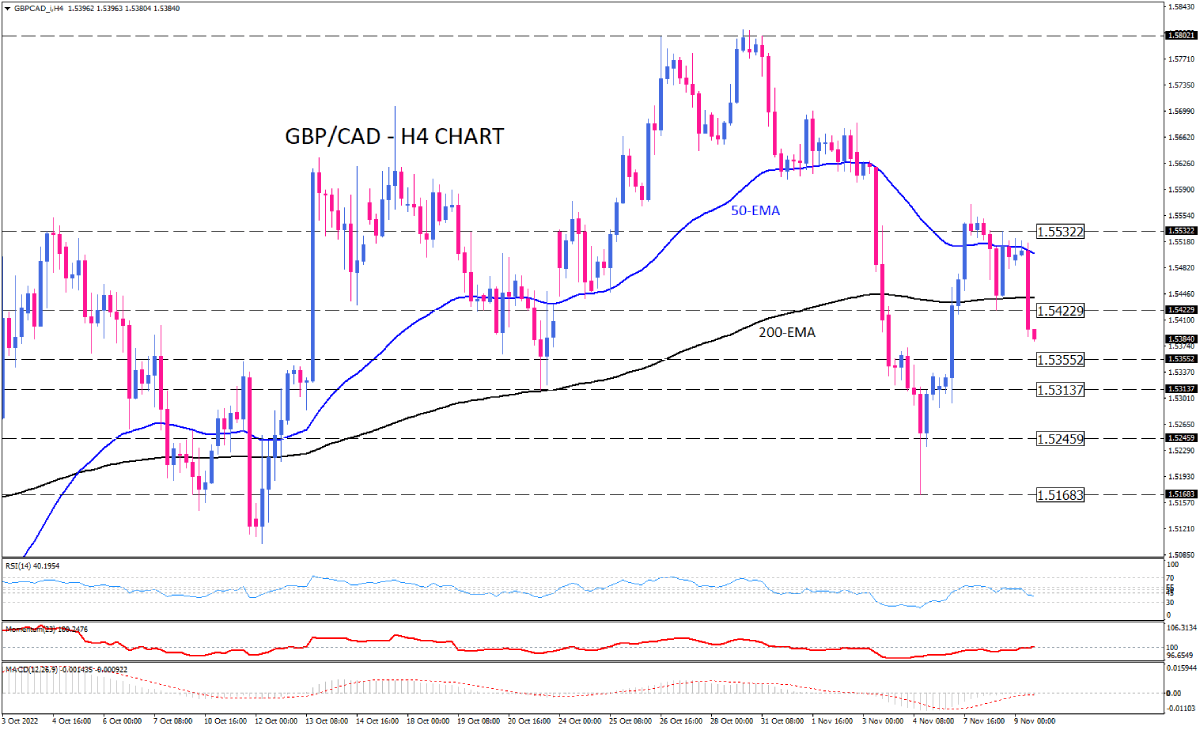

GBP/CAD keeps falling below a key support level

As seen on the four-hour chart, GBP/CAD sellers are dominating the market by reinforcing the decline below the 200-EMA. The move that resulted in a sustained break of the 1.54229 hurdle is now extended with bears targeting the next barrier at 1.53552. If negative momentum persists, further downward movement will put the pair on the back foot to fall towards 1.53137. Then, a close below this level will pave the way to even more decrease to 1.52459 and 1.51683, where the bears can take the one-month low back.

Otherwise, if buyers successfully halt the decline by defending any of the ahead support levels, the outlook will remain bearish until they retake the ground above the 200-EMA.

Short term momentum oscillators imply a mixed picture rather than a clear bearish sentiment. RSI is pointing down in the selling region. However, momentum is hovering around its 100-threshold, which suggests a pretty balance in the market. At the same time, MACD bars have recorded values near zero, which is another indication of neither buyers nor sellers are in full charge.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.