GBP/USD remains elevated at three-month highs

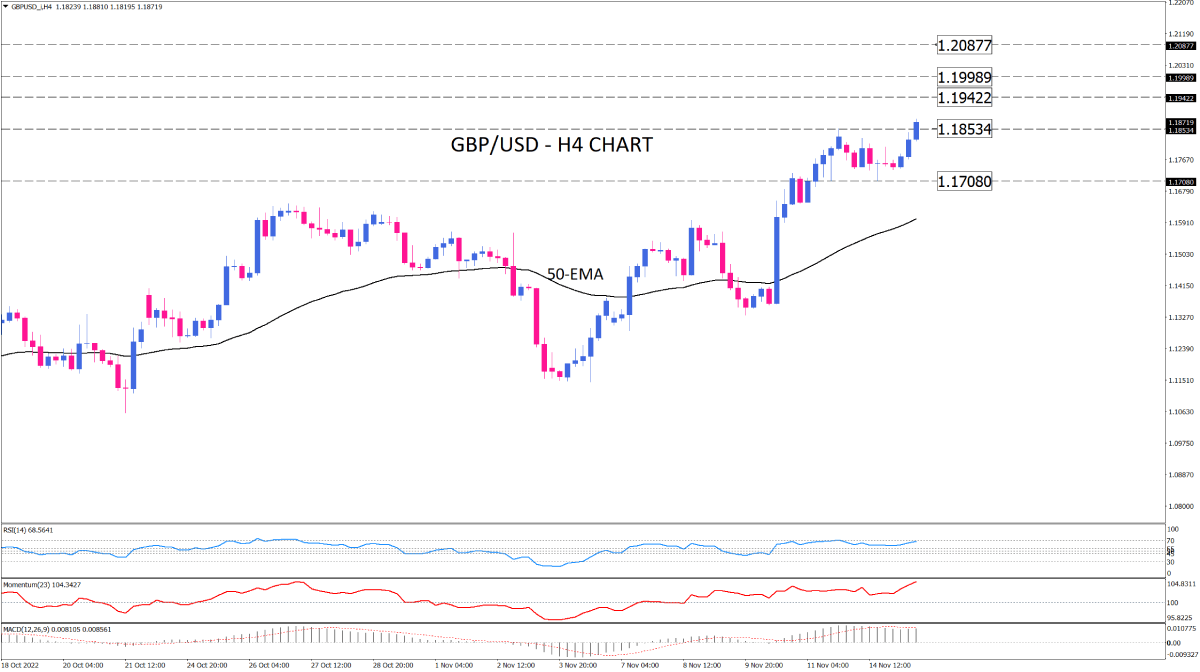

GBP/USD on the four-hour chart has been in an uptrend since late September, forming higher major peaks and troughs. The pound is headed for a winning day ahead of the US market opening on Tuesday as buyers gear up for upside momentum to record fresh highs above the 1.15534 top for the first time since August. If bullish sentiment persists in the wake of a weaker dollar, sterling will find a chance to hit 1.19422. In the event that buyers overstep this hurdle, the price can keep rising towards the next resistance around 1.19989. A break of this barrier will target the 1.20 level, which is considered a crucial psychological level for GBP/USD.

Otherwise, if sellers return to the market, the price could drop below the 1.18534 mark. If that's the case, more sellers will eye the last bottom at 1.17080. A sustained breach of this barricade will trigger a sell signal with bears targeting the 50-EMA.

The bullish bias is supported by short-term momentum oscillators. RSI is on the edge of overbought territory at 70, suggesting that buyers may take a breather. Momentum is moving upwards in favour of a bullish bias. MACD bars are getting taller, attempting to hit the signal line.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.