Gold sellers attempt to make an intraday reversal

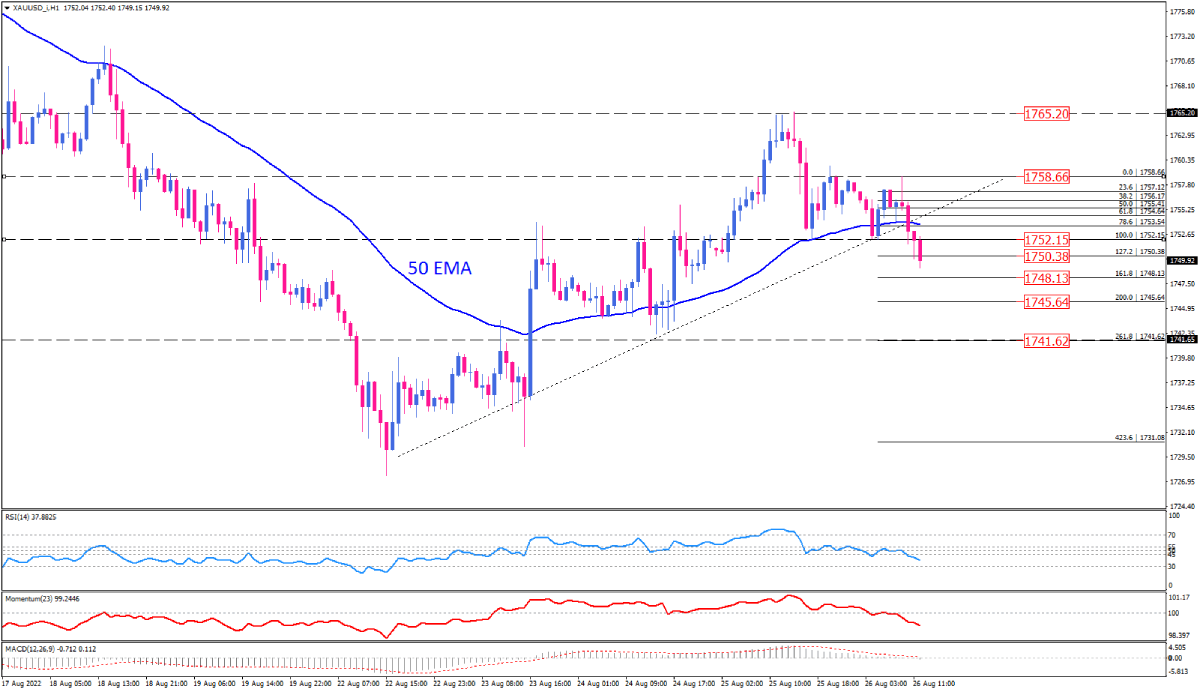

On Friday, a gold last rally got out of steam ahead of Powell’s speech as rising bets on a more hawkish Federal Reserve is strengthening the dollar. On the one-hour chart, the gold uptrend has lost momentum, with buyers retreating from the $1765 market top seen on Thursday. Bearish sentiment is prevailing currently since sellers are challenging with key support at $1752.15, having an eye on the $1750 psychological level. Suppose bears manage to dominate the market below $1752.15. In that case, a bearish reversal will occur on the intraday chart, putting $1750.38 in the sellers’ sight. In the event that this level can’t serve sufficient support, losses can be extended towards the $1748.13. a further decline below this barrier will turn the market attention to $1745.64 and $1741.62, respectively.

Alternatively, a decisive move above the previous top at 1758.66 will keep gold stand by a range, with buyers hoping to reconquer Thursday’s top at $1765.20.

Short-term momentum oscillators imply intensifying bearish bias. RSI is moving down in the selling area, and momentum is also trending downward below the 100-level. Likewise, the MACD histogram nudged down, crossing below zero, hinting at a possible extension of a bearish movement.

Technical Analysis

Discover ideal profit opportunities for your everyday trading with the help of our in-depth technical insights comprised of facts, charts and trends.